Article by: Pam Huntington

Employee Benefits Specialist – CU Insurance Solutions

In relation to healthcare, it’s defined as, “transforming an employer’s health benefit plan into one that puts economic purchasing power—and decision-making—in the hands of participants”*. It’s about supplying the information and decision support tools you need, along with financial incentives, rewards, and other benefits that encourage personal involvement in altering health and healthcare purchasing behaviors.”* It’s safe to say we’re good consumers when we’re shopping for our next vehicle or the items we put in our carts at the grocery store but are we good consumers when it comes to shopping for our medical procedures and prescriptions? We often go to the medical facility recommended by our providers and grab our prescriptions from the most convenient pharmacy, but is this the most cost-effective? With the increase in health insurance costs and high deductible health plans, now more than ever, we need to shift our mindset around healthcare and begin to take control of how and where we spend our hard-earned dollars.

Check your Carrier portals Register for your carriers’ portals. Not only will you have access to your electronic ID cards, plan, and claim information, but you may also be eligible for additional programs and add-ons. Many carriers offer wellness initiatives with rewards and discounts.

Comparing Bills with Explanation of Benefits It’s important to take the time to compare your provider invoices with the explanation of benefits (EOB) you receive from your insurance carrier. The EOB will show your financial responsibility, which should match the bill you receive from the provider. Don’t just pay without completing this key step. Overpayments can take 60 days or more to be refunded, and if you underpay you may be subject to an unexpected charge down the road.

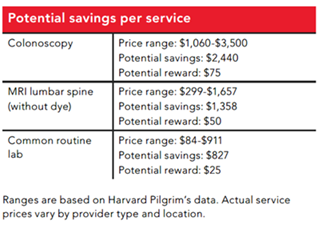

Comparison Tools Most insurance carriers provide cost comparison tools to help you “shop” diagnostic procedures and lab testing. Being a savvy consumer can save you a significant amount of money in your out-of-pocket health insurance expenses. See the below examples from Harvard Pilgrim. Same procedures, but the cost difference can be substantial. Many of these programs offer additional reward incentives for choosing lower-cost facilities. Taking a few minutes to shop for your next procedure or lab test can save you money and put extra cash back in your wallet.

Prescription Resources The convenience of picking up our prescriptions at the same time we grab our groceries seems like a no-brainer, but this might not be the most cost-effective option. Did you know you can “shop” your prescriptions? GoodRx offers a website and mobile app, specifically designed for this purpose. Simply by entering your prescription and zip code information they’ll show you the cost of your prescription at all pharmacies in your area. PLEASE NOTE if you utilize a coupon through GoodRx this will not count towards the deductible/cost-sharing of your medical plan. This is something to consider before using one.

Another tool is to research your drug manufacturers’ websites. Some manufacturers offer coupons as well as financial support. There is a process to apply for financial support, but it can be a momentous financial relief and provide direct assistance towards the deducible/cost-sharing on your medical plan. I’ve personally witnessed the benefits of both these options. I recently had a member whose prescription cost was over $1,000/month through their medical plan and with a coupon, the cost was reduced to roughly $100/month. This is an instance where utilizing a coupon made financial sense.

Essentially you’ve purchased your health insurance. It can be a substantial investment when you consider insurance premiums in addition to the deductible and out-of-pocket expenses. Just like a new vehicle, don’t you want to get the most bang for your buck? Knowledge is power. By just taking a little time you can protect and stretch your dollar.

As always, your Employee Benefits Team is here to assist and answer your questions.

* What Is Consumerism in Healthcare? It’s Lasting Impact On The Industry (nrchealth.com)