Pictured Above: General Motors Co.’s Detroit-Hamtramck Assembly Plant in Detroit, Michigan. Photographer: Jeff Kowalski/Bloomberg

By Tim Dalton | EVP CU Insurance Solutions

In my last article, I had expressed a few predictions about the future of auto lending and the impacts they may have in the near future. Sadly, we are seeing auto manufacturers start to react to the changing marketplace at least domestically. I believe there is still an underlying fear of what happened during the bailout era for the auto manufacturers.

Late in November of 2018 GM announced it will close 7 factories, cutting 14,000 jobs by the end of next year. This will boost GM’s cash flow by 6 billion dollars by 2020. The reasoning behind this, so told by GM, is the realignment to prepare for electric and self-driving cars. Yet after digging deeper into the major changes, some of the real facts emerge. GM stated that “four factories in the US could be shuttered by the end of 2019 if the automaker and the unions don’t come up with an agreement to allocate more work to those facilities.” At the same time, GM is looking to abandon some of its slower selling sedan models. These lines include The Buick Lacrosse, the Chevy Impala, Cadillac CT6, and the Chevy Volt (fully electric car) and Cruze. The Cruze will continue to be made in Mexico but only for other markets outside the US.

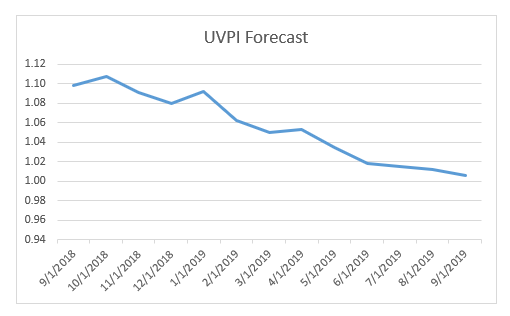

Not to degrade these models that are being dropped, but they are of lower cost than crossover models and they are not selling. Why? The leasing markets. More consumers were leasing in 2015, 2016 and even 2017 and that will start to pour more preowned autos on to the market, hence driving down wholesale prices and lowering values across the board. Still, why were consumers not buying these autos? It comes down to value and what you want for your dollar. You can buy a Chevy Impala for $360 a month or lease a Yukon for $360 a month. You decide.

GM stated that “Most of the one-shift plants are sedan plants” and “That’s a real mismatch in a market where 40 percent of the vehicles sold are crossover utilities.” GM’s thought behind this is to “take action” while the economy is strong. However, the comment stated by GM at this year’s Automotive Outlook Symposium (AOS) was “To stave off the fire sales of the past;” is this statement truer to the positioning of their business model?

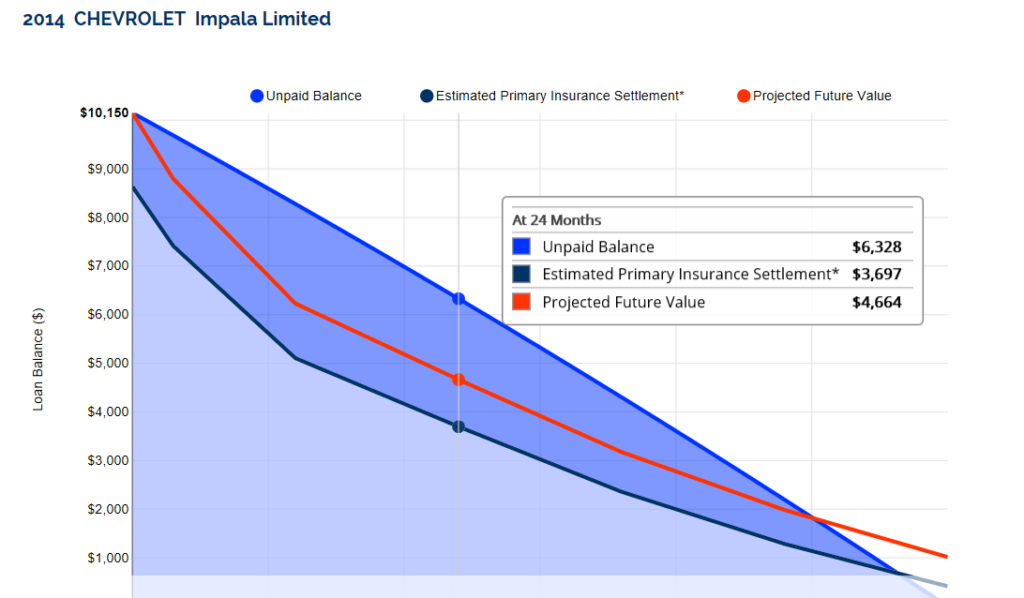

This comes down to a few variables to be aware of and how we continue to lend in the auto market for the future. My first thought is: how will this affect the Loan to Value (LTV) on loans that are currently on the books at our Credit Unions? With the loss of these product lines, how will it affect their values? In the past, when product lines were dropped, values have pitched more heavily downward in value then standard depreciation predicts. Even in a strong marketplace, we see loan values higher than values of the collateral for 70% to 80% of the loan cycle. In your typical 60-month term loan, most vehicles do not turn right side up in value until year 4, and that is if the vehicle is maintained well and kept within the 15,000 miles per year range. My second concern is: how do we lend to members with significant loan deficits at trade, who are left with no other option because of a total loss or severe mechanical issue?

2014 CHEVROLET Impala Limited Based on dealer retail value $10150.00 NADA at 24 months

Disclaimer: Projected Future Values are provided by Automotive Lease Guide. The Estimated Primary Insurance Settlement reflects estimated primary insurance settlement values after a total loss once the deductible has been applied and after adjustments for local market comparisons, actual vehicle condition, mileage and vehicle options. All values represent future projections and are not purported, warranted, or to be construed as absolutes.

I am not predicting that members/consumers will stop paying their loans. However, my concern is with a 22 month turn time where consumers are trading their cars in and high LTV’s are common, what are we going to do to protect both our members and our Credit Unions as our loan values start to change pace in this new auto market? First off, there will be a consumer reaction. Consumers will not be able to get the value they need to purchase and pay off their existing loan balance. Or their payment will be too high to afford, especially in a higher interest rate market place. Credit Unions will want to see more money down to control LTV in a declining value market, steering more members to just keep their current vehicles longer. In turn, this will slow auto sales, slowing auto lending and changing our short-term higher interest note income. We need to be thinking about how to protect the current outstanding loans since the future is looking to a change in loan volumes and loan values.

RVI Analytics UVPI (Used Vehicle Price Index)

But how do we protect those members that do not have the option of just keeping their vehicle longer because of a totaling event or severe mechanical breakdown? The answer is simple, by adding Guaranteed Asset Protection (GAP) to loans to stave off potential loan deficits for our members and adding Vehicle Service Contracts (VSC) help or solve future mechanical breakdowns problems. In this changing market, the relevance of these types of programs is more necessary than ever to protect our Credit Unions’ members.

How do we protect our Credit Union? Through the protection of programs such as LSI (Lenders Single Interest) or CPI (Collateral Protection Insurance). Both programs have benefits for protecting the Credit Union’s assets. LSI is a fee that is charged during the inception of an auto loan. This protects the Credit Union in cases of damage or a total loss even if the Credit Union is in a situation where repossession is occurring. There is no tracking for Credit Union staff since it is charged on every loan. CPI is a no charge scenario, but this demands the member carry insurance for the term of the loan at the same time the Credit Union is charged with tracking insurance information. If the member lapses on their insurance premium forced-place insurance is placed on to the loan modifying the member’s monthly payment. This insurance does not protect the member and does not constitute insurance coverage should the member be involved in an accident. It only protects the Credit Union asset during a repossession event.

Lastly, how can staff help to protect the Credit Union? Training on GAP, VSC and Debit protection more relevant; teaching staff the relevance and value of these programs and the “Why” behind them. These programs offer higher value to your members at a lower cost than the retail business in the marketplace. The better your staff understands the “Why” behind your Credit Union, the more successful the Credit Union will be and the happier your members will be.

Continue to be the best option in your marketplace by offering to help your members to be more financially viable. If your members are financially healthy then so is your Credit Union.