Used Vehicle Depreciation Rates on the Rise Increasing GAP Risk

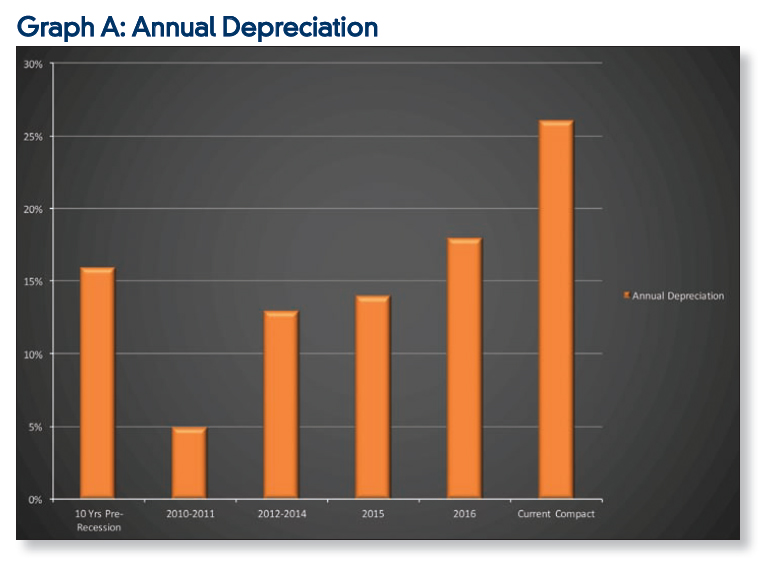

For a decade prior to the recession, used vehicles depreciated an average of 16% per year (NADA Q2 2015 Vehicle Equity). During the recession, vehicle depreciation dropped to a low of 5% annually in 2010-2011, thanks to the Cash for Clunkers program and plummeting new car sales numbers, and then rose back to 13% in 2012-2014, 14% in 2015, and 18% in 2016. Overall, depreciation rates are expected to average around 18% annually through 2017 as used vehicle supply continues to increase rapidly. However, as we saw with trucks and SUVs in the peak of the recession, compact and subcompact cars are seeing significantly worse depreciation. In fact, according to Black Book®, subcompact cars have depreciated 26.1% over the past 12 months. This represents the largest 12-month drop of any segment over the past 10 years.

A recent claim provides a clear example of the impact of this extraordinary depreciation. In April of 2013, a 2011 Volkswagen CC was financed for 75 months at 96% of the then NADA value of $22,200. Three years later, the vehicle was totaled, and with depreciation that averaged ~24% per year on a used vehicle, the loan still showed a deficiency of over $5,400. While average depreciation among all segments might move up and down within a narrower band, individual segments and even particular vehicles can see dramatic swings in depreciation in response to ever changing market conditions and shifting consumer preferences.

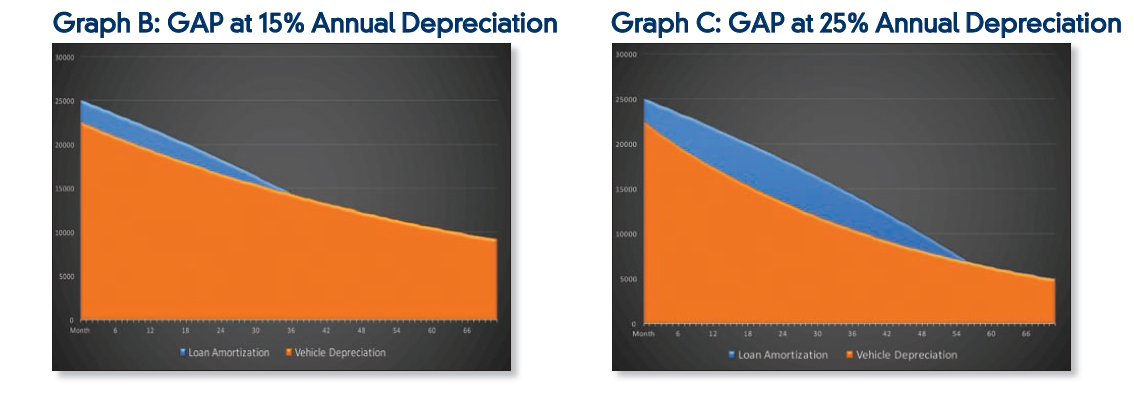

The following graphs help illustrate the significant increase in GAP exposure as vehicle depreciation increases from a more typical 15% per year to a 25% annual depreciation rate that we have been seeing over the past 12+ months on smaller car segments. The areas shaded in blue represent the negative equity in the loan as reflected in the difference between the amortized loan balance and the expected value of the vehicle over the course of the loan at the given annual rate of depreciation. Not only does the number of months that the loan remains under water increase significantly, from 36 months to 56 months on this 72-month loan, but the amount of the deficiency during that period also increases substantially.

In addition to changing consumer preferences, higher incentive spending by manufacturers, and increased off-lease volume, the growth in Certified Pre-Owned (CPO) sales also drives greater depreciation in the used car market. While CPO classification on used vehicles helps increase the market value of the vehicle at time of purchase from dealer lots, the value of the certification is all but gone six or 12 months later when the vehicle is back to being a standard used vehicle. For example, a two-year-old vehicle sold as CPO may get a $1,500 boost in valuation at sale time only to see that benefit disappear within a year, creating exaggerated depreciation that includes the normal vehicle depreciation PLUS the $1,500 credit for CPO. It is nothing more than having a short-term warranty that carries $0 value once the warranty has expired.

Top Factors Driving Increasing Vehicle Depreciation

- New car sales have increased to record levels

- Increased incentives by manufacturers to grow or maintain market share

- Dramatic rise in leasing is driving increase in supply of “off-lease” vehicles

- Changing consumer preferences

- Certified Pre-Owned

The impact of faster depreciation is significant – not only relative to the number of loans in a deficiency balance, but also in how it impacts negative metrics on loan portfolios. An increased number of loans with a deficiency balance unquestionably drives higher GAP losses. Having more loans under water and for a longer period of time greatly increases the potential for GAP claims. Highlighting that impact, we have seen the average months from loan inception to GAP claim increase from a low of 13.3 months in 2014 to nearly 22 months in 2016. This is a clear indication that more loans are staying under water for a longer period of time.

In addition to a dramatic jump in GAP claims, loan portfolios are slowly seeing the impact of strained car values. First, lower car values today mean less equity (or more negative equity) for borrowers when they want to move out of their old car and into a new one. Ultimately, that will contribute toward increasing average LTVs and longer loan terms. Importantly, less equity in vehicles also drives higher default rates – if not seen yet, it is on the near horizon. The probability of repossession is 10.3% when there is negative equity of just $2,000 and increases to 16.4% with negative equity of $5,000 (NADA Q2 2015 Vehicle Equity).

Information provided by Frost Financial Services | www.frostinsure.com

To receive news and informative articles by email from CU Insurance Solutions subscribe to our “Blog Update” by completing the form below.

Contact Us

Special Olympics Maine Fundraising Update

For 21 years, CU Insurance Solutions and Maine Credit Unions have supported Special Olympics Maine with unwavering dedication. Each year, we collectively pull together to share an hour, a day or a weekend to volunteer for a Special Olympics event. Credit unions are always finding creative and heartfelt ways to raise funds. Regardless of the level, every contribution is welcomed and appreciated.

2016 has been no exception, we’ve had a wonderfully successful year raising funds. At our 53rd Annual Meeting on April 29, the CU Insurance Solutions Social Responsibility Committee presented a check for $70,000 to MSO for 2015/2016 fundraising efforts. This year, Saco Valley FCU was presented with our annual Caring and Sharing award and Annette Jacques, a former employee of KSW FCU, was presented with the Sandra A. Doucette Award for her many years of outstanding service, volunteerism and support of Special Olympics Maine.

The 14th Annual CU Insurance Solutions Golf Tournament that took place this July at Spring Meadows in Gray, ME raised a total of $20,000 for Special Olympics Maine.

The winners of this year’s tournament are listed below:

- Gross – 1st Place – Winthrop Area FCU – 63

- Gross – 2nd Place – Better Benefits for ME – 64

- Net – 1st Place – Tricorp FCU Team #2 – 54

- Net – 2nd Place – Superior Lending Solutions – 56.7

- Closest to the Pin – Ladies – Callie Lubinski – 15’3”

- Closest to the Pin – Men – Ben Jordan – 3’4”

- Longest Drive – Ladies – Stacy Edgecomb

- Longest Drive – Men – Scott Seguin

Our 2nd CU Insurance Solutions CU Survivor event that took place September 11 at Maine Forest Yurts “Survivor Camp” in Durham, ME was also in part a fundraiser for MSO with proceeds from T-Shirt sales, donations and a 50/50 raffle donated to the cause. Actually, two of their athletes – Della Lippincott and Brandon Mullen, made an appearance for the day. Both athletes were invited to participate with Brandon playing a major role on the Orange Team.

CU Insurance Solutions would like to thank all of our credit union partners and vendors for your overwhelming financial contributions and dedication to helping at the Special Olympics events throughout Maine.

CU Insurance Solutions would like to thank all of our credit union partners and vendors for your overwhelming financial contributions and dedication to helping at the Special Olympics events throughout Maine.

If you’ve been hesitant to step forward and volunteer for a Special Olympics event, it’s never too late to get involved. With events happening year round, there’s always opportunities for volunteers; from preparing and serving meals and snacks to coaching or coordinating athletic events and more.

The experience will give back more smiles, hugs, and laughter than time and money could ever buy. Contact CU Insurance Solutions to learn how you can help!

Click below to view the 2015-2016 credit union contributions.

2016 CU Survivor Challenge Recap

Watch the entire highlight video on the CU Insurance Solutions Vimeo Channel

The CU Insurance Solutions 2016 CU Survivor event took place on Sunday, September 11, 2016, at Maine Forest Yurts “Survivor Camp” in Durham, ME. ‘Castaways’ from CU Insurance Solutions credit union clients were chosen following a 3 month GAP promotion to compete in a series of fun challenges. The challenges determined which “Credit Union Castaway” would win the grand prize of a weekend stay on Chebeague Island, Casco Bay, Maine.

The proceeds from T-Shirt sales, donations, and a 50/50 raffle were donated to Maine Special Olympics. Actually, two of their athletes – Della Lippincott and Brandon Mullen made an appearance for the day. Both athletes were invited to participate with Brandon playing a major role on the Orange Team.

The Challenges and Tribes

Blue Tribe

Led by Jim Tenhundfeld, (President of FROST), with tribe members: Kim Hebert of Norstate FCU, Dilia Kasimova of Five County CU, Bryan Carle of PeoplesChoice CU and Angela LaRoche of York County FCU.

Orange Tribe

Led by Jon Taylor, (VP of Sales & Marketing at CU Insurance Solutions), with tribe members: Marianne Wise of Rainbow FCU, Cait Gamache of TruChoice FCU, Hillary Greenleaf of Gardiner FCU & Brandon Mullen of Maine Special Olympics

The day began with an impressive parade of Credit Union ‘Castaways’ holding individual tiki torches to the area where the challenges were held. After four “Tribe Teamwork” challenges, the BLUE team held a slight lead. Even though it rained for about an hour, it didn’t dampen our spirits as the challenges safely continued mostly under cover. A delicious lunch was served by Tacos Del Seoul. There were many enthusiastic spectators cheering for their respective ‘Castaway’. There was an especially large group of kids and adults from northern Aroostook County rooting all day for Kim.

In the second half of the day, all the ‘Castaways’ competed on their own. Five of them were eliminated in the next four challenges resulting in 3 finalists, Kim Hebert of Norstate FCU, Cait Gamache of TruChoice FCU and Bryan Carle of PeoplesChoice CU. At the final Tribal Council, the five who were eliminated were asked to vote for one of the 3 finalists. When all was said and done, Kim Hebert from Norstate FCU was chosen the Grand Prize Winner – and was given a weekend at a cottage on Chebeague Island. So, in essence, she actually got voted ONTO the island.

In the second half of the day, all the ‘Castaways’ competed on their own. Five of them were eliminated in the next four challenges resulting in 3 finalists, Kim Hebert of Norstate FCU, Cait Gamache of TruChoice FCU and Bryan Carle of PeoplesChoice CU. At the final Tribal Council, the five who were eliminated were asked to vote for one of the 3 finalists. When all was said and done, Kim Hebert from Norstate FCU was chosen the Grand Prize Winner – and was given a weekend at a cottage on Chebeague Island. So, in essence, she actually got voted ONTO the island.

Each ‘Castaway’ was applauded numerous times during the competition and received a handsome plaque noting their participation in this fun and memorable event.

A special thanks goes out to the following sponsors – Frost, Tricorp FCU, Equinox, Allied Solutions – for helping to make this event a real success.

Watch the entire highlight video on the CU Insurance Solutions Vimeo Channel

Military Lending Act and MAPR Addendum to Loan Forms Solution

As you know, the new mandatory compliance requirements under the expanded Military Lending Act (MLA) take effect October 3, 2016 (except for credit card accounts). The final rule for credit card accounts will be effective October 3, 2017. Some of our credit union partners have contacted us with questions regarding MLA and its impact on the lending process. The questions have been centered around the changes to consumer loan forms necessary to comply with the changes under the MLA. CU Insurance Solutions has researched this unique issue and has provided answers to the below questions your credit unions may have as well.

Do I need to re-map my consumer loan forms to comply with MLA?

It depends on your forms provider. One of our credit union forms partners has (with the guidance of legal counsel) prepared an addendum to work with current consumer lending forms. This addendum not only provides the required MAPR statement, it also disclaims and waives language in existing loan agreements that is not consistent with the MLA for loans to covered borrowers. Using an addendum to loan protects the credit union from prohibited terms in existing loan documents and eliminates the costs associated with a separate set of loan documents.

Do all forms providers share equivalent compliance rulings?

Our forms provider has confirmed that this addendum to loan will meet the requirements necessary to comply with the expanded MLA. However, each forms provider in the marketplace has a unique ruling based on their forms program. Our provider is willing to supply this document to our credit union partners, regardless of your forms provider, at the discretion of the credit union. To clarify, the advocacy of this addendum to loan is ultimately up to the credit union to assume, based on the differing legal opinions of two highly respected credit union forms providers.

- If your credit union would like to utilize the addendum to loan, please let us know.

- If your credit union decides to follow your current MLA forms solution but would like a competitive quote for lending forms, please let us know.

Additionally, if your credit union would like to exercise the option to use any of CU Insurance Solutions’s three forms providers, please note that we cover 100% of the cost of consumer lending forms for our Credit Life & Disability / Debt Protection program clients.

Newsletter Signup

Employer Shared Responsibility Payment

I wanted to make a recommendation to you for future new hires and open enrollments. If you are not already doing so, you may want to consider having employees complete waivers if they choose not to take medical coverage and keeping a copy of the waiver on file. You will want to get an updated waiver each renewal as proof that you offered them coverage in the event that they apply for a subsidy for individual coverage through healthcare.gov. This is particularly important if you have more than 50 employees or may in the next year as it can help protect you from potentially paying the employer shared responsibility payment as you will have documented that you did offer the employee coverage and have something to share with the IRS in the event that they ask.

As always, please let me know if you have any questions regarding the Affordable Care Act or employee benefits.

Elizabeth Ingram

Account Manager, Employee Benefits

CU Insurance Solutions

Phone: 800-287-3379 x 312

info@insurancetrust.us

Small Group Renewal Rates and the New FSLA Overtime Rule

Renewal season is on the way, and I want to remind you that small group rates are only available 60 days in advance of the renewal. For CU Insurance Solutions employee benefits clients, I will be sending out your renewals as I receive them along with last year’s census for an update. In order to facilitate a quick turnaround, please return the updated census along with your most recent invoice (or most recent monthly premium) as soon as possible after I send your renewal. As always, Kim and I will work closely with you and your employees through the renewal process.

Compliance – New FSLA Overtime Rule

As you plan for the coming year, please make sure that you are also complying with the new overtime rules that go into effect on December 1st.

Click the button link below to view the New FSLA Overtime Rule Infographic.

As always, please let me know if you have any questions regarding the Affordable Care Act or employee benefits.

Elizabeth Ingram

Account Manager, Employee Benefits

CU Insurance Solutions

Phone: 800-287-3379 x 312

info@insurancetrust.us

Commercial Insurance: Protecting Credit Unions from Risk Exposures and Vulnerabilities

Though commercial insurance is a necessity for every business, credit unions have many unique coverage needs based on the exposures and vulnerabilities inherent in financial institutions. However, adequate business coverage for credit unions is not a “one-size-fits-all” proposition. The insurance needs of an institution can vary greatly based on individual risk factors. Coverages like Bond, Directors & Officers, Plastic Card and Cyber Liability can be complex and require careful assessment to ensure that all exposures are suitably protected in the event of a loss. As a result, business insurance can be a difficult area for a credit union to navigate. Our goal is to highlight the resources that are presently available through CU Insurance Solutions, and our subsidiary, Equinox, to safeguard the best interests of Maine credit unions with customized business insurance products and related services.

Products

CU Insurance Solutions is a trusted advisor to more than 30 of Maine’s credit unions for commercial business coverages. Through our subsidiary, Equinox Financial & Insurance Services Inc., we provide a wide range of insurance programs offered by well-known, highly-respected and financially strong insurance carriers including:

- Credit Union Bond

- Management Liability

- Cyber Liability

- Property and General Liability

- Workers Compensation

- Mortgage Impairment and Errors & Omissions Coverage

- Blanket Mortgage Hazard

- Lender Placed Hazard, General Liability and Flood Insurance

- Special Events Insurance

- Umbrella

- Business Auto

Service

Equinox acts as a trusted advisor to provide guidance for all your credit union insurance needs. We provide local personalized service and are available to meet with you at your convenience. Our agency provides assistance with the administrative burden of coverage applications and will work to simplify the process to make it easy and understandable. We have helped credit unions save thousands of dollars annually on their bond and insurance programs while providing comparable, and in many cases, more comprehensive coverage than competitor programs.

The Value of a One-Stop Agency

Sometimes commercial insurance coverage can overlap into other areas that credit union lending protection or even employee benefits programs reach. A major advantage to utilizing CU Insurance Solutions for commercial bond and other business insurance products is that we coordinate between business divisions to evaluate your entire insurance portfolio to identify any potential redundancies in coverages that could save your credit union money. Another benefit of having your coverages consolidated with one agency is that we can help you to understand how your coverages respond in the event of a loss.

Please feel free to contact CU Insurance Solutions Vice President of Business Development, Beverly MacMillan by email: bmacmillan@insurancetrust.us or by phone at 207-887-8251 for a complimentary review of your current business insurance coverages. Equinox can perform a risk analysis as well as make cost-saving recommendations for your credit union.

The same reason why CU Insurance Solutions was founded in 1963 is the very reason why we turn our lights on every single day: to provide competitive insurance coverage options for Maine credit unions and their members.

ACA Update – Opt-Out Payments

As you know, under the ACA employees who have access to ‘affordable’ health insurance from their employer are not eligible for subsidies, and large employers (50+ FTEs) must offer affordable coverage. This year (2016), affordable means that the employee’s portion of individual health insurance premiums is less than 9.66% of their household income; in 2017 that number rises to 9.69% of income. What you might not know is that opt-out payments can affect the affordability calculation. Conditional opt-out payments – you only provide opt-out payments to employees who are not enrolled in your plan but are enrolled in another plan that satisfies the minimum coverage requirements of the ACA – do not affect affordability. Unconditional opt-out payments – you provide opt-out payments to any eligible employee who decides not to enroll in your plan – DO affect affordability.

Here’s an Example

Employees who enroll in your health insurance must pay $50/month in premium for individual coverage. However, you offer an unconditional opt-out of $150/month to eligible employees who decide not to enroll in your coverage.

As a result, your employees who enroll in your health insurance are deemed to pay $200/month for the purposes of the affordability calculation. In this case a full-time employee’s annual pay will need to be at least $24,845 in order for coverage to qualify as affordable. If you don’t offer the opt-out pay (or it is conditional), your full-time employee only needs to make $6211 a year for coverage to be affordable.

As always, please let me know if you have any questions regarding the Affordable Care Act or employee benefits.

Elizabeth Ingram

Account Manager, Employee Benefits

CU Insurance Solutions

Phone: 800-287-3379 x 312

info@insurancetrust.us

Sources:

http://www.bna.com/irs-proposes-rules-b73014444675/

Broker World, July 2016. Janet Letourneau’s ‘Affordability Determination, Government Entities, And Benefits Administered By The VA And HSAs

Member Products: The Key to Loan Portfolio Sustainability and Growth

Perhaps one of the greatest opportunities that credit unions have to sustain and grow non-interest income today exists with offering ancillary loan protection programs to members. Products like GAP, Vehicle Service Contracts, and Credit Life & Disability insurance help credit unions increase non-interest income, protect members when life interferes with their ability to repay loan obligations and proactively safeguards loans from delinquencies and charge-offs. Most credit union loan portfolios favor auto lending which presents a daily challenge in terms of creating profitable loans in our highly competitive loan rate marketplace.

Because lending insurance programs have a strong correlation to the health of credit union lending, insurance agencies like CU Insurance Solutions/CUAlliance play an important role in the success of a credit union. Most credit unions are not, nor should they be, expected to be insurance experts. That’s why service, training and technical support are important resources to expect of your insurance agency to assist in maintaining effective member programs. Our goal is to highlight the resources that are presently available through CU Insurance Solutions to aid credit unions with convenience, expertise and support to protect member loans and support portfolio sustainability and growth.

Training Support

We are dedicated to providing comprehensive training resources to credit unions through our ongoing CU Insurance Solutions University initiative. Our yearly curriculum includes many different training delivery channels to accommodate the unique needs of all credit unions, including:

- Traditional Classroom: Product knowledge-specific face-to-face interactive training presentations, customized to accommodate small or large groups.

- Live Web-Based Training: Monthly webinars hosted by CU Insurance Solutions and our vendor partners, to provide refresher training and new program demonstrations.

- Recorded Training Library: Access to our library of pre-recorded webinars that are viewable anytime.

- Semi-Annual Lending School Events: CU Insurance Solutions hosts nationally recognized credit union industry speakers for both Spring and Fall live lending workshops. These events provide best practices to help improve the lending process, sales results and the critical essentials for lending success.

Due Diligence

Our agency was created specifically to provide competitive alternatives to member insurance programs that serve the best interest of Maine credit unions. CU Insurance Solutions is continually performing vendor due diligence to deliver industry-leading member services that yield the greatest overall benefits for credit unions and their members. In this way, when unexpected things happen with a particular insurance program or carrier, CU Insurance Solutions has competitive options at the ready.

Sharing Back

In the spirit of our origins as a trust created by credit unions, we are devoted to continually sharing back in several ways with our partners. Here are some of the ways we share back:

- Free Consumer Lending Forms: We pay for 100% of the cost of consumer lending forms for our Credit Life & Disability / Debt Protection program clients.

- Discounted Tuition: We offer relationship pricing for CU Insurance Solutions University lending school events presented by national credit union industry speakers.

- Sponsorship and Fundraising Support: We provide sponsorship support for many credit union events and fundraising efforts for our partner credit unions.

If you are interested in taking advantage of any of these CU benefits, please feel free to contact us.

The same reason why CU Insurance Solutions was founded in 1963 is the very reason why we turn our lights on every single day: to provide competitive insurance coverage options for Maine credit unions and their members.

Newsletter Signup

Trust Tips – GAP to the Rescue

A recent real-life GAP claim from one of our credit union clients.

Make: Ford

Model: F-150

Year: 2006

Mileage: Wicked High (a Maine pick-up truck!)

Financed Amount: $18,300

NADA value: $16,075

The truck was totaled just 2 months after it was financed.

The Bad News

The members auto insurance company assessed the value of the vehicle at only $8,700 just 2 months after the NADA was assessed at $16,075. This resulted in a $9,700 deficiency balance from the amount still owed on the loan.

The Good News

The credit union loan officer convinced the truck owner to place a GAP waiver on this loan agreement and the $9,700 was paid. Plus an extra $1,000 was applied towards this member’s next financed vehicle with that same credit union.

Trust Tip

Because insurance companies frequently pay settlements that are far less than NADA valuations, the value of the vehicle financed may be much less than what is assumed – particularly without full inspection. This can especially be the case on older and high mileage vehicles. Know the risks and explain the benefits of GAP on every loan. Your credit union and members will be glad you did.