Join our Team: Account Relationship Manager

CU Insurance Solutions has an immediate opening for an Account Relationship Manager.

For 60 years, CU Insurance Solutions, previously Insurance Trust, has been a premier provider of insurance products for credit unions throughout Maine and New England. We are a small team of 14 insurance professionals dedicated to providing competitive insurance coverage options for credit unions, their employees, and their members.

This hybrid position is based at the CU Insurance Solutions office in Westbrook and will require extensive travel (approximately 2 days/week with 3-4 overnights/month) in Maine as well as in greater New England; occasional evening hours are required. Non-travel days can be worked remotely outside of any required in-person meetings. Including travel time, an average week may be 40-45 hours, occasionally up to 50 hours a week.

Primary Duties and Responsibilities:

• Sales and service of member lending and insurance-related products

• Facilitate relationships with insurance carriers, vendors, and credit unions

• Work closely with the rest of the Member Lending team

• Anticipated growth opportunity into member lending team lead

Qualifications:

• High school graduate with proficiency in Microsoft Office

• Property & Casualty license – we will provide training for the right candidate

• Life & Health license – we will provide training for the right candidate

• Valid driver’s license

• Strong communication skills

• A sales or credit union background is strongly preferred

• Relationship builder

Preferred Qualities:

• Committed/Passionate

• Reliable

• Positive

• Driven and Self-motivated

• Team-oriented

• Detail-oriented

• Humble

• Honest

• Respectful

CU Insurance Solutions, LLC (www.ciscuso.com) offers competitive pay ($55,000-$60,000 plus incentive plan) and a comprehensive benefits package including 100% employer-paid medical premium; employer-paid HSA and HRA contributions; employer-paid life, disability, and long-term care insurance; voluntary dental, voluntary vision, and additional voluntary coverages; paid vacation, earned paid leave, birthday, and 13 holidays; opportunities for continuing education and professional development. A laptop and cell phone are provided.

Interested applicants should send a cover letter and resume to: Elizabeth Ingram: elizabethi@ciscuso.com.

• Our Mission:To provide quality service, education and insurance solutions that best serve the unique needs of credit unions and their members.

• Our Vision: We strive to continually provide competitive marketplace options to allow credit unions to remain protected, successful, and independent while providing cost-effective and industry-leading benefits for credit union members and employees.

• Core Values: Passion, Integrity, Partnership, Respect, Education

Deduction Calculations

Article by Elizabeth Ingram

VP of People Strategy – CU Insurance Solutions

Determining an employee’s Insurance Deduction Calculations isn’t always a lot of fun, but making sure they are correct is essential for both the employee and employer.

Deduction calculations happen at renewal time (before and after), as well as any time an employee comes on or off the plan mid-year OR makes changes. If the employer changes how much they contribute to premium, the employee calculation needs to be re-done as well.

How to make deduction calculations? First you need to determine several items, preferably in tandem with your accounting department.

- Are deductions paid for the current month or paid in the month ahead? If possible, we recommend paying in the current month so that if an employee leaves, they haven’t overpaid.

- Are deductions calculated on a monthly or annual basis? Your accounting team may have a preference.

- Either way there may be ‘odd’ pennies, so let your accounting team know when to expect them.

- If calculating monthly, in months with an extra payroll (5 for weekly or 3 for bi-weekly) those ‘extra’ payrolls will not get a deduction.

- If calculating on an annual basis, there will be a deduction for each payroll.

- Odd pennies: it is unlikely that your employee premiums will be perfectly divisible by year or month, so you will need to decide when to charge these. We do ours at the beginning of the plan year.

- Some deductions are weekly; these do not require calculating the deduction. Examples include: 401ks and Long-Term Care.

- Some deductions are weekly but may require calculating the deduction to allow the employee to max out their coverage. Examples include: HSAs and FSAs.

You will then need to calculate the deductions.

Sample calculations for weekly payroll:

Dental (monthly premium – calculated on a monthly basis)

- $40.25 (sample premium)

- 4 weeks/month: $10.06/week ($40.25/4) – if there’s a fifth paycheck, no deduction is taken

- Annual premium: $483/year (40.25*12)

- Determine odd pennies

- 4 months have 5 Fridays, so only 48 deductions should be taken

- $10.06*48=482.88

- $483-482.88=0.12

- First deduction should be: $10.18

- $10.06+0.12=$10.18

- If an employee is only eligible for 11 months, you would use 11 months and 44 weeks to calculate the total.

HSA (annual maximum – calculated on an annual basis)

- $4150 (individual 2024 maximum) – keep in mind the family maximum is higher, individuals age 55+ can put in an additional $1000/year, any employer match comes out of the maximum, and an eligible employee can put in any amount up to the maximum.

- $4150/52=$79.8 (to max out the HSA for the year with a weekly payroll)

- Determine the odd pennies for maxing out the deduction

- $79.8*52=$4149.60

- $4150-4149.60=0.40

- First deduction should be $80.20

After deduction calculations are made, you need to communicate them to employees. We recommend the use of a payroll deduction worksheet which includes all benefits and requires an employee signature.

Employee Benefits Nondiscrimination Testing

If you offer any pre-tax employee benefits, you need to have a Section 125 (also known as a POP or Cafeteria Plan) in place. These benefits may include your medical, dental, vision, life, disability, voluntary benefits, FSA, HRA, or more.

After your plan year ends each year,* you need to complete non-discrimination testing for your POP benefits.** The testing is designed to confirm your plan doesn’t provide excess benefits to executives.

Testing should be completed by a qualified outside party; if you need suggestions, we can provide options. Many vendors require you to have a benefit with them prior to testing. Each vendor uses a different template, so if you change vendors, don’t be afraid to ask clarifying questions.

There is no reporting requirement for this testing, but if the IRS audits your plans and you haven’t completed and passed the testing and made necessary corrections, fines will be imposed. Make sure you record and file the results of your test, as well as any adjustments or corrections.

If you aren’t sure whether your benefits will pass a non-discrimination test or think the plan may be on the border, you can have testing completed throughout the year. If you do fail a non-discrimination test, be sure to take corrective action and document, document, document! Less is best does not apply to compliance!

In this event, the excess benefits are taxable to the employee (preferably this should be done in the same plan year) via W2. When there is more than one impacted employee, the excess tax should be done in proportion to their deductions.

As with a 401k, some POPs may have a safe harbor exception, but this cannot be used when there is an HSA involved.

We recommend:

1) Reaching out to us for vendor options

2) Asking the vendor clarifying questions regarding the testing

3) Reviewing & saving your test results

- a) If you do fail testing, speaking to an ERISA attorney with any questions

- b) Looping back with us if you need to make benefits changes or have additional questions after testing.

*Your plan year is based on the plan year for your POP document which is often, but not always, aligned with your medical renewal. Take a look at your plan document to confirm your plan year. If you don’t have a POP, our benefits team can connect you with vendor options.

**Your 401k is probably a standalone benefit that requires its own non-discrimination testing completed by a TPA (third-party administrator). If it is standalone, it should not be included in your POP non-discrimination testing.

The Case for Maxing Out Your HSA

Article by Elizabeth Ingram

Vice President of People Strategy, CU Insurance Solutions

I tell people more often than I probably should, that the one change I would have made to my benefits early in my career, would have been to max out my HSA sooner. At the time, I was young, didn’t really understand what an HSA was, and wanted to save for an apartment of my own. To be fair, HSAs are hard to understand. But here’s why you should max yours out (if you have an HSA-compatible health plan).

An HSA is a health savings plan. It’s a bank account that you own, and the funds in it are yours.

HSAs are triple tax-advantaged: putting funds in saves you on payroll taxes at the time, the interest isn’t taxable, and you don’t owe taxes when you spend the funds. If you have an individual HSA, you might save $300+ in taxes by maxing out your HSA for one year.

Your employer might put funds in the account; this lowers what you need to put in for funds and can be looked at as a raise. If your employer puts in $1000 and you make $50,000, participating increases your salary by a non-taxable 2%.

If you don’t have any medical expenses, it may feel as though you’re simply putting funds you could use elsewhere in an inconvenient location. But, you (your spouse and/or kids) will have medical (dental and vision) expenses at some point; for example: my contacts cost nearly $1000 a year after my vision insurance allowance.

Many HSA compatible plans have deductibles or out-of-pocket limits that are higher than the HSA limit. Saving money now means there’s a better chance the funds are there when you need them (on those years that you do hit the deductible). You can think of it as a medical emergency account.

You can invest funds that you don’t need if your funds are at a financial institution with that option.

HSAs can be used for medical expenses in retirement. A typical 65-year-old couple can currently expect $315,000 in lifetime health expenses.

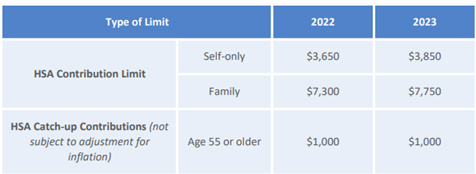

Save money, stress less about your medical expenses, and consider maxing out your HSA. The 2023 limits are $3,850 for an individual and $7,750 for family coverage. Individuals age 55 and older can contribute an additional $1000 per year.

Home Energy Conservation and Efficiency Tips

Article By: Trevor Pietila

Accounting Specialist

With Inflation in 2023 hovering around 6%, we are all feeling the impact on our finances. The price of homes, vehicles and food have gone through the roof. As we head into another New England winter, budgeting for the rising energy costs is a big concern. Here are some ideas to help you save money this winter.

Change your Lightbulbs to LED:

The price of LED lightbulbs has dropped dramatically in the last five years which has made them extremely affordable. Compared to a traditional lightbulb, LEDs use up to 90% less energy and can last up to 20 times longer. You can get name-brand LED lightbulb 12 packs for $20 at Walmart!

Get a Programmable Thermostat:

You could save up to 10% on your heating cost annually, by switching to a programmable thermostat. If you still have an old mercury thermostat, consider watching a quick and easy YouTube video and installing a simple programable one for around $40 each. You can easily set your temperature lower at night and have the house nice and warm by the time you typically wake up!

Take Advantage of the Heat from the Sun:

Heating and cooling typically account for nearly half of a home’s total energy consumption. In the winter, open your shades during the day and allow the sun to naturally heat up your house! When the sun goes down, close your blinds or curtains to keep in the heat and create an insulated air barrier!

Maintain your Systems

Get your furnace/boiler cleaned annually; not only does it allow them to function as intended, but they will remain much more efficient, using less gas or oil. Heat pumps also need to be maintained. A little preventative maintenance goes a long way to not only save on energy costs but allow the systems to last longer and avoid any emergency maintenance calls $$$.

Replace Old Appliances with Energy Star Certified Ones

The Energy Star program provides a certification on some appliances that meet certain efficiency standards of energy efficiency. Update those older appliances with an Energy Star appliance. Energy Star appliances can save up to 30% on energy cost versus a standard appliance.

Eliminate Drafts

Check all your external doors and windows for cold air entering the house, use caulking, and check your weatherstripping for signs of wear. If you have older windows, consider putting up a thin layer of plastic for the winter to help keep the cold air out and the warm air in by creating an insulating air barrier.

Use Ceiling Fans

Ceiling fans typically turn counterclockwise pushing the cool air down, but most fans have a reverse switch, which creates an updraft that pulls the hot air from the ceiling onto you.

Small changes can have a big impact on your energy bill, and in general, a net energy decrease for your household will not only help your wallet but help the environment. As technology improves, other alternatives become available, and states will promote these products with subsidies or rebates. Check out www.efficiencymaine.com/at-home/ for the most up-to-date rebates in the state of Maine.

Financial Wellness Tips & Resources for Employees and Individuals

Article by Elizabeth Ingram

Vice President of People Strategy, Insurance Trust

Benefits Offerings (Ideas for Employers)

This fall we’re in the process of budgeting as well as a transition to a new business structure which means that we’re also taking a close look at all of the benefits we offer. As an employer, it’s important to match our benefits to the wants and needs of our employees. This year the adjustments we’ve made have been relatively inexpensive, but they still help our employees to bring home more of their paycheck.

For me, one of the hardest parts of administering benefits is remembering that everyone has different needs and budgetary priorities. Not everyone can afford to max out their Health Savings Account (HSA) or get the entire 401k match. And some may not see the advantage of doing so; I still kick myself for not maxing out my HSA before I had kids. As an employer, it is not our place to judge; but it is our job to listen to what employees suggest whether it’s: ‘could you look at a dependent care FSA?’ or ‘are you making any changes to the HSA contribution?’ If you don’t take those suggestions, be sure to loop back with the employee and explain why. Sometimes, they may have simply been curious. However, sometimes, it may have been a big deal.

It’s okay to remove benefits that aren’t being used, but be sure to let your staff know why and if you’d be open to restarting them in the future.

I keep seeing articles about how employees expect their employers to provide financial wellness education and assistance. It’s a bit overwhelming on the surface. I mean, I love spreadsheeting my budget and assets, but it’s not for everyone. So, what can make it easier?

Give your employees time and resources. Time can be harder to grant, but it’s a precious gift to be able to meet a financial advisor or attend a webinar during the workday.

Your company 401k advisor might also advise individuals; find out if there’s a cost, then let your staff know. This way they don’t have to search for an advisor if they don’t want to but can get individual help on their household’s whole retirement and financial picture.

Additionally, many 401k providers offer free online tools for retirement planning and daily finance; if you aren’t sure that yours does, ask.

See what’s available in your state for education. In Maine, FAME (Home – FAME Maine) provides regular, free webinars on topics from college expenses to budgeting hacks. They also offer other tools.

Reach out to local credit unions; they may have tools or advisors that your staff could make use of.

Consider having a financial wellness coach come in to speak with your team; there may be a cost to you, but it offers staff an opportunity to get financial education in a setting where they can ask questions as well as receive new tools to help with budgeting.

Remember, financial concerns can’t be turned off at work, but by providing your employees with tools and time, you can reduce those concerns and strengthen your bond with employees.

Take time to show you care.

Financial Wellness for Individuals

Inflation is eye-popping when the sale price of items is higher than the regular price of items a year ago; wow! Clipping coupons and watching sales helps in the moment (I highly recommend it), but you need to look at the big picture too.

Take advantage of any free financial resources your employer provides you with information on. Not everything will be helpful to you, but you won’t know unless you check it out (see some tools above).

If you can afford to and you are eligible, max out your HSA (health savings account). You may not need the money now, but tax-free funds for medical expenses are guaranteed to be of great value at some point in the future. Even if you use the funds for medical expenses now, you still save on taxes.

If you can afford to and you are eligible, put enough money in your 401k to get the full employer match. It might not do you much good now, but a match increases the money in your account now and results in more available funds at retirement. Take advantage of the free money where you can.

Find a budget tool and asset tool or spreadsheet that works for you. The combination of budget and asset information will make it easier to see where you can cut back and see where you want to be in the future. You may only want to track some expenses but including all of your fixed monthly and annual expenses will let you know where you have wiggle room. The best tool is one you understand and use.

Lastly, find a person (or online tool) for questions. It’s always good to have an impartial person to bounce your questions and concerns off of.

Good luck with your financial future!

When was the last time you visited your local library?

Auburn Public Library in Auburn, ME | Courtesy of maineanencyclopedia.com

Article by: Ruthie Noble

Member Lending Account Manager – CU Insurance Solutions

When the internet burst onto the world two decades ago, some said libraries as we knew them, were doomed, but they adapted and continued to be essential in their communities.

Libraries evolved again in the middle of a world health crisis. With doors locked and patrons isolated at home, librarians, known for their creativity, expanded efforts to keep people engaged and connected. Streamed author talks were introduced; story times, cooking demonstrations, and language lessons were offered; tons of e-books, movies, TV shows, and pandemic-related resources became available. Expectations have been raised and resources have broadened from this experience. However, in addition to all that, you still might be surprised to learn of the expanded, non-literary additions and services being offered to patrons ~ and at absolutely no cost to borrow!

In speaking with staff from each corner of the state, here are a few highlights as to what libraries are now offering:

- Pittsfield Public is one of 10 libraries across the state taking part in the Health Connect pilot program that provides access to telehealth care services to their communities. Dedicated, private meeting space is equipped with entirely relevant technology for virtual appointments, consults, wellness visits, and counseling.

- Both Lewiston Public Library and the Patten Free in Bath have several “American Girl” dolls to lend, each from a specific historical period, including a companion book and a full kit of accessories. In contrast, Lewiston also makes available a kilowatt electrical measuring kit to help homeowners determine current, voltage, and energy consumption.

- Auburn Public, like Lewiston, subscribes to Mango, an award-winning, online language-learning program with dozens of adaptive lessons available. In addition to crafting kits, there is also a media lab for the digitization of photos and/or documents.

- Topsham Public has fishing gear and binoculars.

- McArthur Public in Biddeford has an impressive array of recreational gear to lend, including snowshoes, a volleyball set, pickleball, disc golf, bocce balls and croquet.

- South Portland Public has a unique collection of framed original artwork, prints and photographs, with a broad mix of options ranging from nature, historical and contemporary pieces, all available to borrow. Seed Sharing has been introduced for patrons interested in planting home gardens.

- Rockport Public has several ukuleles in their collection, ready to lend! If star gazing is your interest, along with Falmouth and Portland, there are also table-top telescopes available for check out.

- Gardiner Public partners with the Boys & Girls club to offer free meals for kids during the summer months. Along with Waterville Public, patrons may borrow yard equipment such as pruners and trimmers, for example.

- Skowhegan Public Library and Prince Memorial, serving Cumberland and North Yarmouth will lend an array of board games and puzzles. In the summer season, Prince invites families to gather for monthly movie nights. Films are screened outdoors on the lawn, and free popcorn is available to viewers!

- Caribou Public offers educational STEAM activities in various themes such as science, math, anatomy, geography, civics, nature, and even a Maine kit. Hand-held instruments such as cymbals, bells, and tambourines are found in the music kits. A world globe is available to lend. Patrons may swap and sell at the “Book Store”.

- Mark & Emily Turner Memorial Public in Presque Isle offers on-site yoga classes and gathering space for Latin, chess, and knitting clubs. There is a café for snacks. They feature a gallery of fine art pieces and offer guided tours. The library also serves the public as a passport agent.

- Bangor Public boasts 4 art galleries with unique and rotating exhibits. There is a Summer Music Series with live, on-site performances. Cooking, photography, science, and other demonstrations of interest are offered. The library hosts an annual spring-time plant swap.

- Fort Fairfield Public offers free genealogy classes with direct links to favored internet sites.

- New Gloucester Public will lend canoes and kayaks! They also boast an expansive cake pan collection for the creative baker. Patrons are welcome to take or add to a centrally located, free, seasonal garden basket.

York Public and many other libraries I spoke with offer adventure backpacks designed for exploring specific local natural areas and come with trail maps, books, DVDs, and related equipment. It was exciting to discover most offer state park and museum passes. I also discovered some libraries belong to a network of Shared Lenders, thereby allowing cardholders to borrow materials from area participants with a single library relationship.

Several such as Pittsfield, Lewiston, Auburn, Thomas Memorial in Cape Elizabeth, and Merrill Memorial in Yarmouth partner with Kanopy, a video streaming service where thousands of movies, documentaries, foreign films, and classic cinema can be viewed for free on most any device – just create an account using your library card!

In addition to all of these broader programs, libraries continue to provide a quiet space with access to a wide variety of books, films, newspapers, and magazines as well as often offering free internet access. It seems the mission of libraries evolves and remains relevant, as the needs of communities continue to evolve. I hope this will provide you an incentive to visit your local library soon if you are “overdue”.

Consumerism Tips for Medical/Dental Debt/Collections Reporting to Collection Bureaus

Article by: Pam Huntington

Employee Benefits Specialist – CU Insurance Solutions

I have been in the health insurance arena for many years now, but in one of my prior roles, I was a Collections Manager at a credit union. It was staggering to see the amount of credit reports with medical debt collections. The stark reality is all of us are only one sickness or accident away from needing our health insurance benefits.

With the rising cost of care and health insurance deductibles, we could be faced with large out-of-pocket expenses. In a recent article from Benefits Pro regarding health care debt, it states that in the past five years more than half of U.S. adults reported they’ve gone into debt because of medical or dental bills. 100 million people in U.S. saddled with health care debt | BenefitsPRO

There are some options, and one we are seeing more folks doing is applying for Care Credit. I know my family has personally used this for larger-than-expected orthodontia care. Care Credit often allows you up to 24 months of interest-free payments, and you can set those payments to automatically pull from your Health Savings Account (HSA).

A helpful consumer tip with Care Credit. Their monthly statements can be a “little tricky” as they continually show a lower amount due after a payment has been made. It could be tempting to just pay the minimum payment each month but at the end of the term you may not have paid your balance in full. Consequently, you could end up owing interest charges on your entire initial balance at rates in the 20%+ range!

If you find you have a debt that has gone to a collection agency, here are some tips that can help you navigate the process. First, keep the communication lines open with the collection agency and often you will find the outcome will be better. The collection agency does reserve the right to place the account on the consumer’s credit report. As the consumer, you can always ask the collection agency to keep the account from being reported to the credit bureaus while you are in repayment as a term of repayment. The collection agency, however, is under no obligation to do so. Remember, the answer is always no unless you ask the questions.

If the collection agency reports the medical collection to the credit bureau, the consumer has another option available to them. Once they pay the account in full, they can ask the collection agency to remove the account completely from their credit report. Again, the collection agency is under no obligation to do so, but I have found many are willing to do this once the account is paid. You may soon have some medical debt wiped from your credit report: Here’s why (msn.com)

As always, make sure you are reviewing the bills you receive from your providers to be sure they match what the carrier states is your responsibility on your Explanation of Benefits (EOB). Your Employee Benefits Team is always happy to help review these with you.

Back to School Health Advocacy

Article by Elizabeth Ingram

Vice President of People Strategy, CU Insurance Solutions

Don’t get me wrong, we’re all thrilled that school has shifted back to normal – full-time! Field trips! However, the paperwork!

Keep in mind that as a parent, you need to advocate for your kid and both daycares and schools require copies of up-to-date immunizations as a starting point. To make things a bit easier on yourself, here are a few tips.

Check state law or check with your child’s primary care physician (PCP), well in advance of starting school, to see what immunizations are required for public school to make sure you won’t have any enrollment issues.

Every time your child gets a shot at a well-child visit, ask for 2 copies of their updated immunization sheet then & there. Bring one home and file it, but immediately put the second set into your child’s school bag with a sticky note for the appropriate person. If you are at a flu clinic or such, you may not be able to get the updated record right away, but typically flu shots aren’t required in schools, so this probably won’t be an issue.

Remember that most school forms need to be updated annually. If you can, plan ahead because doctors’ offices get inundated with requests for forms as school and sports start up. Often you can request the forms you need through a patient portal if your children are young; otherwise, give the office a call.

If your child has special needs: mental, physical, allergies, or behavior, you’ll want to make sure that you have a meeting with the appropriate team as school gets started as most individual plans get updated each year. Make sure you notify the school of any special needs before school starts but don’t expect to have a meeting until at least a few weeks into the school year. It doesn’t mean your child won’t be cared for in the meantime, but a formalized plan might have to wait. You will want to make sure that if your child has an allergy, their teacher is aware, and the classroom is free of the allergen if need be.

If your child needs specialized medicine to keep at school, for example, epi-pens, plan ahead. Your insurance might only allow you to fill one prescription within a certain time frame, and you need to be sure your medications at home are filled too. I generally request refills in late July if I need them for an early September start. Make sure you get the prescription your child needs and don’t be afraid to educate pharmacists or nurses if you’re confident (in a nice & polite way). I’ve found that many people don’t know that you aren’t supposed to separate the 2 epi-pens that come in a pack because you may need the second one if there is a secondary reaction over the course of the next 24 hours or a particularly severe reaction that doesn’t react to the first pen; you need 2 sets of epi-pens (1 for home & 1 for school), NOT to 2 epi-pens.

Check with your school nurse to determine the best way to send in medications and what other information to include: original packaging, an updated asthma plan, etc.

The school may have other forms you can choose to complete, so make sure you read all the paperwork emailed to you or sent home. For example, in our district, we always have the option to opt-in to allow the nurse to provide certain OTC medications as needed. Choose what works for you.

Lastly, remember your child’s PCP and the school are working with you to keep your child cared for, but you are the advocate. Don’t be afraid to use your voice to ask questions and educate, and encourage your child to do the same.

Health Savings Account (HSA) – Facts, Questions and Misconceptions

Article by: Heather Baird

Account Manager – Employee Benefits, CU Insurance Solutions

As employee benefits consultants and educators, we receive many questions in relation to Health Savings Accounts (HSA). Here are some common questions, as well as lesser-known facts and misconceptions, you’ll want to be aware of when offering and utilizing an HSA.

First and foremost, if the coverage for an employee’s High Deductible Health Plan (HDHP) is effective any day other than the first of the month (i.e. date of hire- DOH) an HSA cannot be opened until the first day of the following month (i.e. DOH = April 15th– HSA effective date = May 1st).

Once an HSA is established, employees will need to determine their contribution amounts. HSA contributions are established annually by the IRS. If an employee and spouse are on two separate HDHP and both contribute towards an HSA, they cannot exceed the combined family maximum. It’s commonly misunderstood that one parent with dependents can contribute the family maximum and the spouse on a single plan can contribute an individual maximum. This is NOT the case. $7,300 is the maximum family limit for a taxable family unit in 2022. This includes all employee and employer contributions. Additionally, if an employee changes employers and plans mid-year and opens a new HSA, their annual maximum contributions will include contributions from all HSAs, not to exceed annual maximums.

That being said, under the last-month rule, if an employee becomes newly eligible on the first day of the last month of his or her tax year (December 1st for most people), they are treated as having the same HDHP coverage for the entire year as is in place on the first day of the last month. This allows employees to contribute the maximum limit. Note, contributions can be made up to April 15th of the following year (applies to all HSAs). If an employee fails to be an eligible individual during the year, they can still make contributions until April 15, for the months they were an eligible individual at the prorated amount.

If an employee decides to take advantage of this rule, they must be aware of the Testing Period. If they fail to remain an eligible enrollee (enrolled in a HDHP) through the subsequent 12 months (i.e. December 1, 2021, through December 31, 2022) they will be subject to a 10% additional tax.

Notes on dependents

An employee’s dependents do not need to be covered under their HDHP to utilize HSA funds. Employees may use HSA funds to pay for medical, dental, and vision costs for taxable dependents not covered under their plans.

So, what if your dependents aren’t taxable? Under the ACA, medical plans must allow dependents up to the age of 26 on the plan, but if a dependent is enrolled under their parent’s HDHP and filing their own taxes, they are not eligible to utilize their parent’s HSA funds. This qualifies a non-taxable dependent to open and contribute to their own HSA. Because the dependent is covered under a family qualified HDHP, they are eligible to contribute the family maximum $7,300 (2022). There are no limits on who can contribute to an HSA, so if a dependent is financially unable to, a parent or loved one can contribute to the account on their behalf post-tax. One important note, the funds in this HSA can only be used for this dependent’s out-of-pocket medical expenses. They cannot use them for any of their spouse or taxable dependents’ costs.

Employees need to keep in mind if they go from Employee + Child or Family coverage to Single coverage mid-year contributions need to be adjusted accordingly.

Medicare and HSAs

As employees near age 65 and Medicare eligibility, they need to be aware of HSA rules. There is a six-month retroactive Part A coverage period. Retroactive coverage in Medicare Part A occurs as follows:

- Enrollment in (premium-free) Part A coverage within six months of turning age 65 will trigger retroactive Part A coverage that is effective the month the employee turns 65. (If the person’s birthday is the first of the month, coverage will start the month before he or she turned 65.)

- Enrollment in (premium-free) Part A more than six months after turning 65 will make Part A coverage retroactive for six months (but no earlier than the month one turns 65).

Employees need to determine in advance when they are going to enroll in Medicare then stop making HSA contributions in the preceding six months.

Also note, starting at age 55 the IRS allows an additional $1,000 annual “catch-up” contribution, and at 65 individuals can withdraw HSA funds for any purpose without penalties, if taken out for expenses other than medical income tax will be applied.

If you have specific HSA questions, we recommend you reach out to your tax advisor for guidance.